The global Battery Energy Storage Systems integrator market grew increasingly competitive in 2022, with the top five global system integrators accounting for 62% of overall BESS shipments (MWh), according to the latest analysis by Wood Mackenzie.

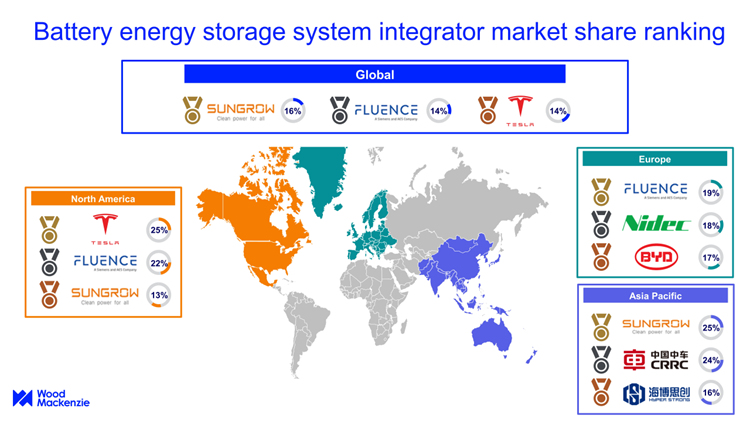

According to the report, Sungrow dominated the market with 16% of global market share rankings by shipment (MWh), jointly followed by Fluence (14%) Tesla (14%), Huawei (9%) and BYD (9%).

Kevin Shang, senior research analyst at Wood Mackenzie, said, “As major policy developments propel the battery energy storage systems market, the BESS integrator industry is becoming increasingly competitive. While existing system integrators are striving to increase market share, the fast-growing energy storage market has also attracted many new entrants to this space.”

“A common feature behind the leading BESS integrators is that their global presence allows them to access a larger customer base and unlock additional revenue streams."

Shang continues, saying, “While global battery supply eased in 2023, after experiencing supply tightness the previous year, the limited supply of transformers has become the new bottleneck of the energy storage supply chain.

"The industry is struggling with short supply and price spikes of transformers, with a minimum lead time of more than one year for transformers of all sizes. This has a direct impact on system integrators as transformers are integral for grid connection.”

Note: The market share calculation is based on integrators’ battery energy storage system shipment numbers in 2022; the number includes both grid-scale and community, commercial & industrial sectors. Source: Wood Mackenzie

North America leading the way

The North American BESS integrator market is concentrated, with the top five players holding 81% of the region’s market share in 2022. Tesla led the region with 25% market share rankings by shipment.

Following Fluence (at 22%), Chinese company Sungrow held its third position with a 13% market share in the North American market in 2022. This high ranking is largely attributed to the company’s cost competitiveness and advanced liquid-cooling products.

“The Inflation Reduction Act and state-led clean energy policies will drive growth in the storage market. We forecast that the competition in the US BESS integrator market will become increasingly over the coming years. Companies need to act on a robust business strategy to succeed in a highly competitive market.”

Asia Pacific

China led the Asia Pacific BESS integrator market, with an 86% market share in 2022.

Shang concluded, “China’s integrator market is becoming increasingly competitive, squeezed heavily by both upstream and downstream supply chain participants. Possessing manufacturing capacity on key components, like cell, PCS, BMS and EMS, tends to be a necessity rather than a plus as bid requirements for energy storage projects become more detailed and stringent.

“The price war among system integrators has started in China. We’ve observed an increasing number of players willing to sacrifice profits in exchange for market share, dragging down the profitability of the whole industry. However, we forecast that aggressive bid strategies with little margin will not be sustained. Intensifying market competition will make it difficult for companies with low profitability and no clear competitiveness to survive over the coming years.”

Pages you might like

Pages you might like

Latest information

Latest information

Follow official account

Follow official account

Online support

Online support

鄂ICP备2022017323号

鄂ICP备2022017323号

鄂公网安备 42018502006493

鄂公网安备 42018502006493

Launch Exhibition

Launch Exhibition

Release information

Release information

Today's topic

Today's topic